Overview

The Coffee Gold Project in Canada’s Yukon Territory is one of the largest and highest-grade heap leach projects in the world: 3.0 million ounces of Measured and Indicated resource within 80 Mt at 1.15 g/t gold (0.18 g/t gold cut-off). At a higher 0.40 g/t cut-off, Coffee has approximately 2.8 million ounces of Measured and Indicated resource within 60 Mt at 1.44 g/t gold. The project is well-advanced through permitting and engineering, with a clear path to production, and agreements are in place with two First Nations.

Coffee Gold Project Mineral Resource Estimate

| Resource Category | Tonnage (kt) |

Gold Grade (g/t) |

Metal Content (gold koz) |

Strip Ratio (waste:ore) |

|---|---|---|---|---|

| Measured | 1,200 | 1.80 | 69 | 5.1 |

| Indicated | 78,846 | 1.14 | 2,888 | |

| Measured + Indicated | 80,046 | 1.15 | 2,957 | |

| Inferred | 21,200 | 1.17 | 800 |

Location

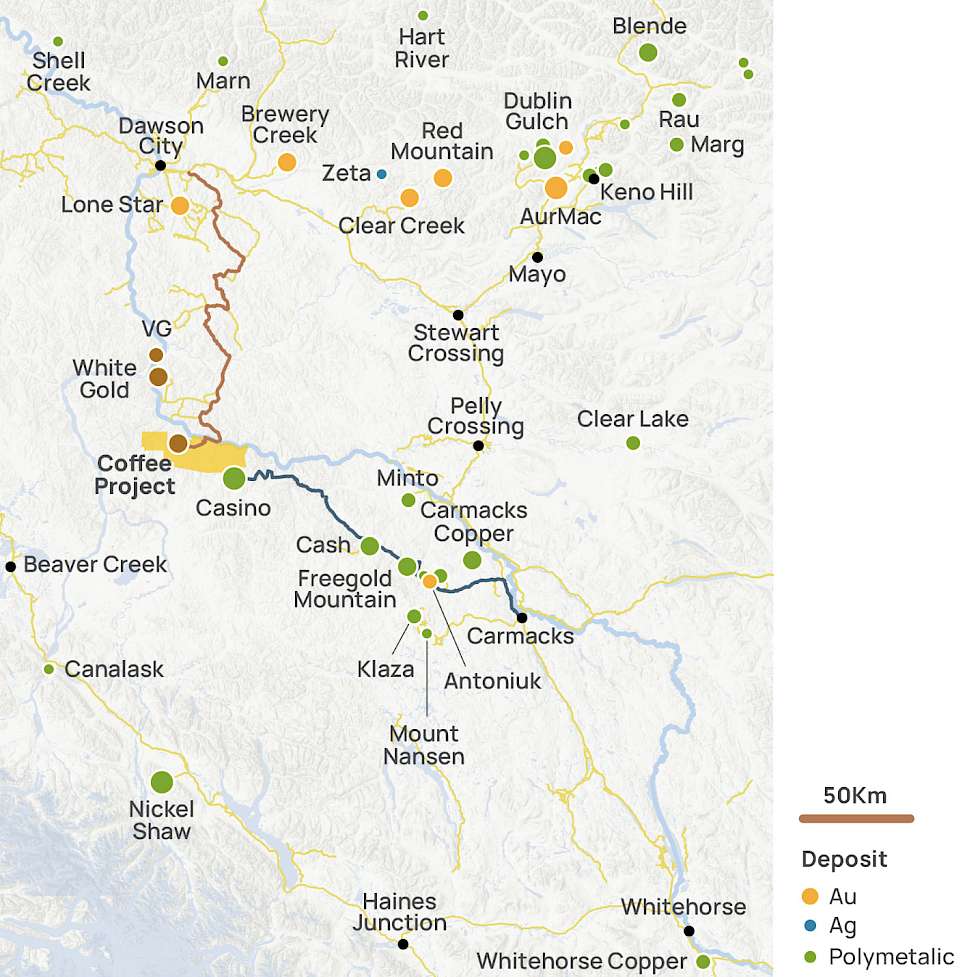

The Coffee Gold Project is approximately 130 km south of Dawson City and 95 km north-east of Beaver Creek in Canada’s Yukon Territory (Figure 1). The project is situated within the prolific Yukon- Tanana Terrane (YTT), and within the wider Tintina Gold Province, which hosts numerous multi-million-ounce deposits and producing mines including Kinross’ Fort Knox Mine and Snowline’s Valley deposit. We respectfully acknowledge the Coffee Gold Project is located within the traditional territories of the Tr'ondëk Hwëch'in, Selkirk First Nation, White River First Nation, and the First Nation of Na-cho Nyäk Dun.

Geology

The Coffee Gold Project hosts 3.0 million ounces of open-pit heap-leach Measured and Indicated resource, as well as an Inferred Resource of 0.8 million ounces. The project is situated within the prolific Yukon- Tanana Terrane (YTT), and within the wider Tintina Gold Province, which hosts numerous multi-million-ounce deposits and producing mines including Kinross’ Fort Knox Mine and Snowline’s Valley deposit. The lack of glaciation in the Yukon Territory has allowed for the preservation of extensive oxide ore deposits such as Coffee and the nearby Casino copper-gold deposit.

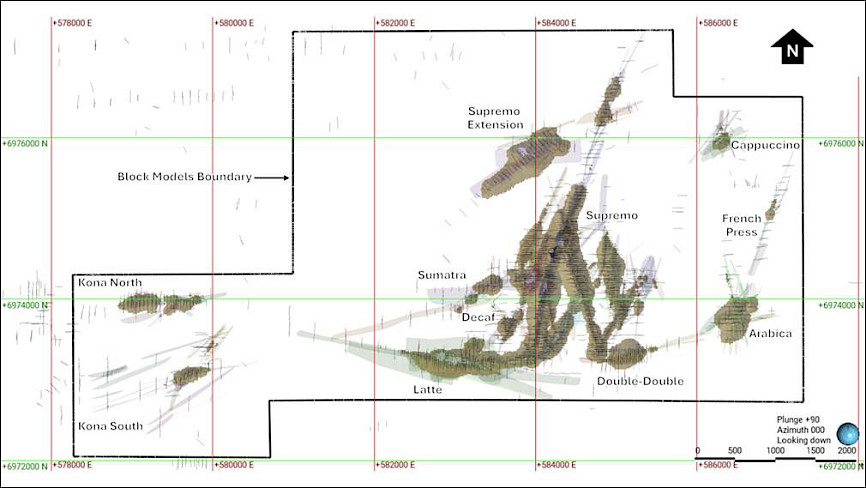

Exploration drilling has led to the discovery of gold mineralization in 15 separate areas (Figure 2): Supremo, Sumatra, Latte, Double-Double, Arabica, Americano West, Americano, Espresso, Kona, Kona North, Supremo Extension, Cappuccino, Dolce, French Press, and Sugar. Gold mineralization occurs in narrow to broad gold-bearing locally brecciated structures with quartz, albite, ankerite, dolomite, sericite, and pyrite alteration. The gold mineralization found to date is hydrothermal in origin and both structurally and lithologically controlled.

Mineral Resource Estimate

- Measured and Indicated gold resource of 2.96 Moz, consisting of 80 Mt at a grade of 1.15 g/t gold at a weighted average cut-off of 0.18 g/t.

- Sensitivity analysis shows a robust resource at considerably higher cut-off grades:

- At a 0.4 g/t cut-off, Measured and Indicated resource of 2.80 Moz (60 Mt at a grade of 1.44 g/t gold).

- At a 1.0 g/t cut-off, Measured and Indicated resource of 2.16 Moz (30 Mt at a grade of 2.19 g/t gold).

- The entire resource is amenable to conventional open-pit, heap-leach mining and processing to produce gold doré bars.

- Numerous nearby targets provide excellent opportunities for resource expansion as shown by sparsely drilled areas not included in the current resource estimate.

- Excellent potential for the future delineation of high-grade sulphide resources below the oxides, as evidenced by high-grade (>5 g/t gold) sulphide intercepts in the relatively few deeper holes.

The updated mineral resource estimate and the sensitivity analysis are presented in the tables below. Drill data for the project was collected between 2010 and 2023 by previous operators Kaminak Gold Corporation (“Kaminak”), Goldcorp Inc. (“Goldcorp”), and Newmont. A total of 3,307 reverse circulation (“RC”) holes totalling 376,291 m and 1,261 diamond drill holes totalling 238,284 m were used in the resource estimate. The estimate was prepared by Micon International Limited (“Micon”) in accordance with National Instrument 43-101 (“NI 43-101”) with an effective date of August 21, 2025.

Coffee Gold Project Mineral Resource Estimate

| Resource Category | Tonnage (kt) |

Gold Grade (g/t) |

Metal Content (gold koz) |

Strip Ratio (waste:ore) |

|---|---|---|---|---|

| Measured | 1,200 | 1.80 | 69 | 5.1 |

| Indicated | 78,846 | 1.14 | 2,888 | |

| Measured + Indicated | 80,046 | 1.15 | 2,957 | |

| Inferred | 21,200 | 1.17 | 800 |

Notes to Table 1

- Economic parameters used in the resource are a gold price of US$2,500/oz; heap leach average recoveries for the individual metallurgical domains of 86.3% for Oxide, 76.0% for Upper Transition, 54.5% for Middle Transition and 31.4% for Lower Transition; a mining cost of C$3.27-$3.50/t, processing costs of C$6.64/t, and general and administrative costs of C$6.0/t. A CAD:USD exchange rate of 1.35 was also assumed.

- The calculated cut-off grades vary between 0.13 g/t Au and 0.48 g/t Au, depending on the metallurgical domain. The global weighted average cut-off grade is 0.18 g/t Au, with domain tonnage contributions comprising 64% Oxide, 18% Upper Transition, 5% Middle Transition, and 13% Lower Transition.

- Pit slope angles vary between 45.0 and 48.8 degrees depending on the pit area.

- Pit optimization was done on 12x12x10 m re-block model with a minimum of 4x4x5 m regularized SMU.

- Numbers have been rounded to the nearest for thousand tonnes and ounces. Differences may occur in totals due to rounding.

- The mineral resources described above have been prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum Standards and Practices.

- Messrs. Alan J. San Martin, P.Eng. and Charley Murahwi, P.Geo. from Micon International Limited are the Qualified Person (QP) for this Mineral Resource Estimate.

- Mineral resources are not mineral reserves as they have not demonstrated economic viability. The quantity and grade of reported Indicated and Inferred mineral resources in this news release are uncertain in nature and there has been insufficient exploration to define any measured resource; however, it is reasonably expected that a significant portion of Inferred Mineral Resources could be upgraded into Indicated Mineral Resources with further exploration.

- Micon's QPs have not identified any legal, political, environmental, or other factors that could materially affect the potential development of the mineral resource estimate.

Mineral Resource Sensitivity Table

| Cut-off Grade (g/t) |

Measured + Indicated | Inferred | ||||

|---|---|---|---|---|---|---|

| Tonnage (kt) |

Gold Grade (g/t) |

Metal Content (gold koz) |

Tonnage (kt) |

Gold Grade (g/t) |

Metal Content (gold koz) |

|

| 5.0 | 1,524 | 7.46 | 365 | 270 | 6.53 | 57 |

| 4.0 | 2,613 | 6.20 | 521 | 595 | 5.37 | 103 |

| 3.0 | 5,049 | 4.86 | 789 | 1,370 | 4.27 | 188 |

| 2.0 | 11,519 | 3.49 | 1,291 | 3,396 | 3.16 | 345 |

| 1.5 | 18,557 | 2.82 | 1,682 | 5,447 | 2.62 | 460 |

| 1.0 | 30,720 | 2.19 | 2,162 | 8,833 | 2.09 | 593 |

| 0.9 | 34,136 | 2.07 | 2,267 | 9,761 | 1.98 | 622 |

| 0.8 | 37,933 | 1.94 | 2,370 | 10,806 | 1.87 | 650 |

| 0.7 | 42,307 | 1.82 | 2,476 | 11,993 | 1.76 | 679 |

| 0.6 | 47,357 | 1.70 | 2,581 | 13,390 | 1.64 | 708 |

| 0.5 | 53,362 | 1.57 | 2,687 | 14,998 | 1.53 | 736 |

| 0.4 | 60,445 | 1.44 | 2,789 | 16,662 | 1.42 | 760 |

| 0.3 | 67,671 | 1.32 | 2,871 | 18,351 | 1.32 | 779 |

| 0.2 | 75,209 | 1.21 | 2,931 | 20,190 | 1.22 | 794 |

| 0.1 | 80,046 | 1.15 | 2,957 | 21,200 | 1.17 | 800 |