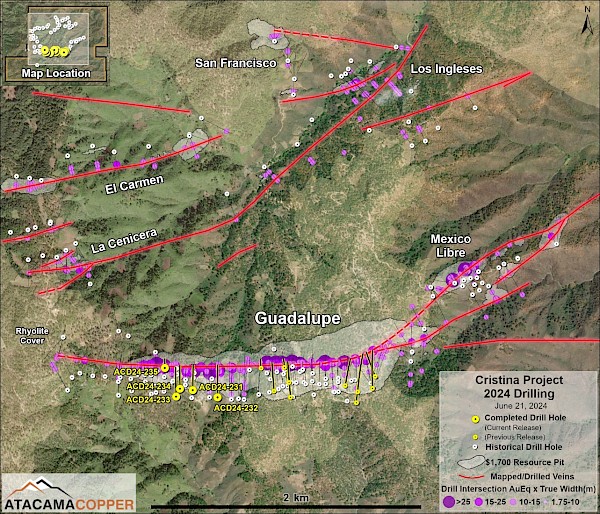

Vancouver, British Columbia – July 8th, 2024 – Atacama Copper Corporation (TSXV: ACOP) (“Atacama” or the “Company”) is pleased to report results from five holes of a 10,000-metre diamond drilling program at its wholly-owned Cristina precious metals project in southwestern Chihuahua State, Mexico. Atacama has now reported fifteen holes totalling 4,467.5 metres of drilling as part of a 40–50-hole drill program. The Cristina project consists of multiple outcropping quartz veins that are frequently greater than 10 metres in width and extend for at least a five-kilometre strike length. Four parallel mineralized vein zones have been mapped and sampled to date, with most of the existing mineral resource estimate at Cristina contained within only one of the vein zones, the Guadalupe vein (Figures 1 and 2).

Drilling Highlights

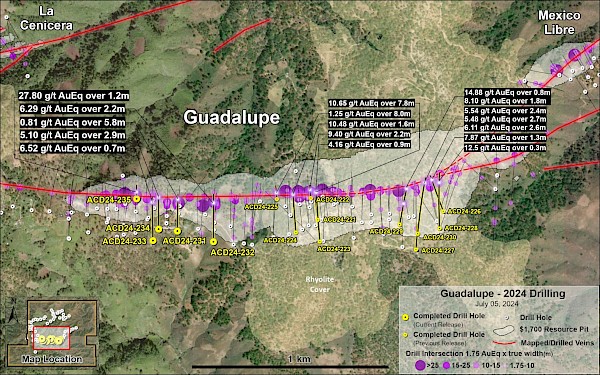

Highlights of the holes reported here, all from the eastern portion of the main Guadalupe vein system, include:

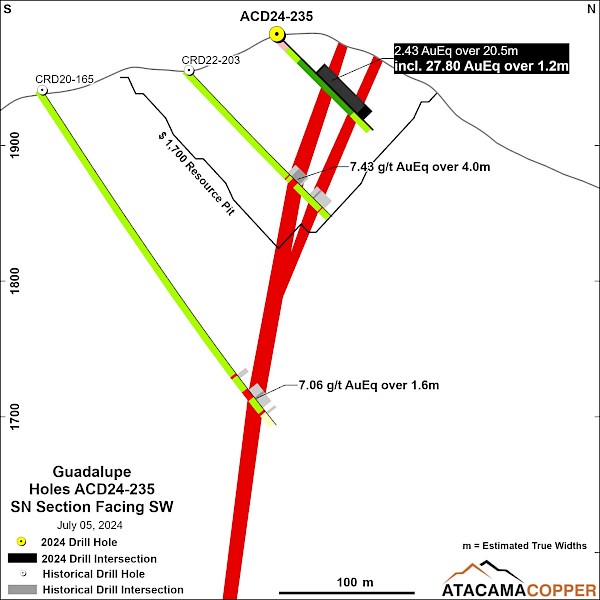

- 27.8 g/t AuEq over 1.2 m estimated true width (22.3 g/t Au, 184.0 g/t Ag, 0.87% Zn, 0.82% Pb and 1.42% Cu) in hole ACD24-235

- This 1.2 m wide intercept occurs within a broader zone of mineralization measuring 2.43 g/t AuEq over 20.5 m estimated true width (1.56 g/t Au, 24.5 g/t Ag, 0.31% Zn 0.27% Pb and 0.17% Cu)

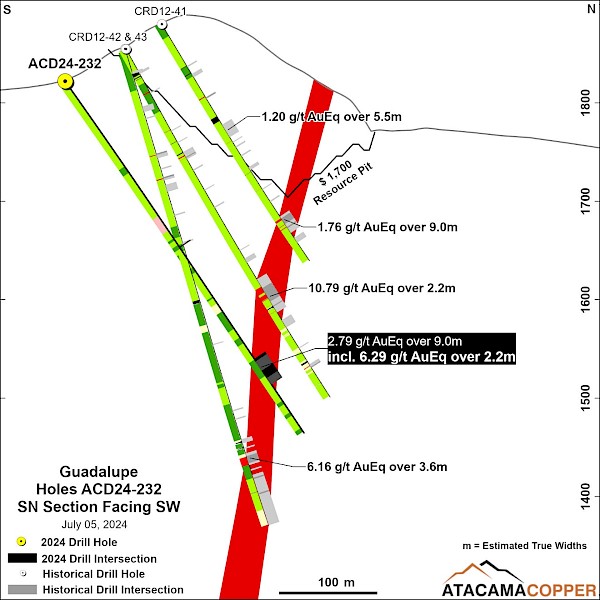

- 6.29 g/t AuEq over 2.2 m estimate true width (0.84 g/t Au, 69.4 g/t Ag, 6.20% Zn, 2.10% Pb and 0.26% Cu) in hole ACD24-232

- This 2.2 m wide intercept occurs within a broader mineralized zone measuring 2.79 g/t AuEq over 9.0 m estimated true width (0.70 g/t Au, 33.1 g/t Ag, 2.12% Zn, 0.71% Pb, 0.15% Cu).

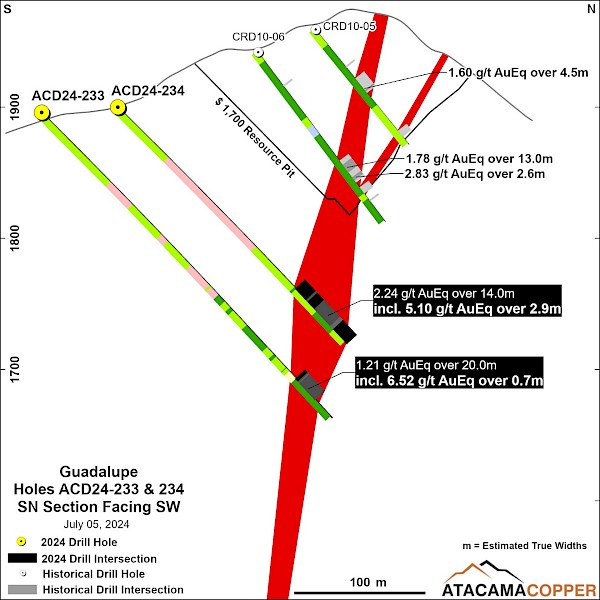

- 6.52 g/t AuEq over 0.7 m estimated true width (0.65 g/t Au, 65.1 g/t Ag, 7.22% Zn, 2.41 % Pb, 0.14% Cu) in hole ACD24-233

- This 0.7 m wide intercept occurs within a broader mineralized zone measuring 1.21 g/t AuEq over 20.0 m estimated true width (0.43 g/t Au, 19.6 g/t Ag, 0.56% Zn, 0.24% Pb, 0.06% Cu).

- 5.10 g/t AuEq over 2.9 m estimated true width (2.78 g/t Au, 75.0 g/t Ag, 0.98% Zn, 0.66% Pb and 0.33% Cu) also in hole ACD24-234

- This 2.9 m wide intercept occurs within a broader mineralized zone measuring 2.24 g/t AuEq over 14.0 m estimated true width (0.96 g/t Au, 39.2 g/t Ag, 0.71% Zn, 0.41% Pb and 0.13% Cu).

Tim Warman, Atacama’s CEO, commented: “Cristina continues to deliver high-grade drill results over significant widths from the Guadalupe vein, as we work to delineate and define a robust underground resource estimate. We’ve seen some of the highest gold grades encountered at the project in hole ACD24-235 at shallow depths, and mineralization remains open at depth across this most recently targeted western high-grade horizon.”

Geology and Context of Results

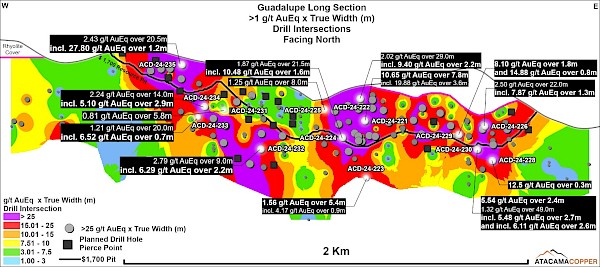

All five holes reported here were drilled towards the western end of the Guadalupe vein system.:

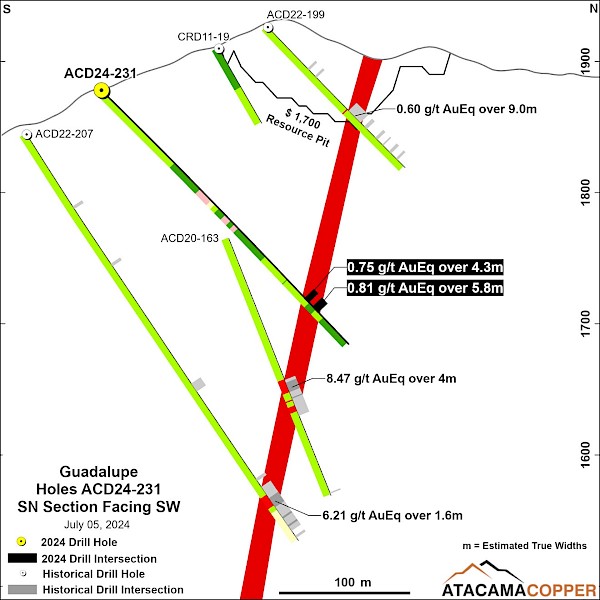

- ACD24-231 encountered relatively low grades defining the upper limits of the higher-grade horizon marked by strong continuous grade in previous holes drilled deeper on this section (Figures 3 & 4). The mineralization remains open at depth.

- ACD24-232 fills in a gap and demonstrates continuity of high-grade mineralization over approximately 200 vertical metres in this part of the vein (Figures 3 & 5), with mineralization open at depth.

- ACD24-233 and -234 both intercepted higher-grade mineralization to approximately 150 m below the base of the resource pit filling a gap and adding continuity to the higher-grade horizon (Figures 3 & 6), with mineralization open at depth.

- ACD24-235 was intended to fill in a near-surface gap in drilling and encountered some of the highest gold grades yet at Cristina, with a 27.8 g/t AuEq intercept over 1.2 m estimated true width including a gold component of 22.8 g/t Au (Figures 3 & 6, Table 1). This hole expands the near surface, higher grade horizon further to the east and demonstrates a vertical extent of approximately 250 metres from surface, remaining open at depth.

The Cristina deposit is an epithermal to mesothermal vein system where the mineralisation is predominantly gold and silver, with lesser base metal values. At least four known parallel vein zones trend east-west to northeast-southwest and are hosted in an andesitic volcanic sequence which forms part of the Lower Volcanic Sequence of the Sierra Madre Occidental range. The andesites are intercalated locally with dacitic intrusions and related lava flows and breccias, and the sequence is in turn cut by andesitic and hornblende-plagioclase porphyry following fault trends. In some areas the veins are covered by post-mineral rhyolite of the Upper Volcanic Sequence.

Cristina is similar in style and grade to Fresnillo’s nearby and very profitable San Julián underground mine, which hosts mineralisation in two different types of ore bodies: (i) narrow low-sulphidation epithermal veins and (ii) broader zones of lower-grade disseminated sulphides in subvolcanic and volcanic felsic rocks. San Julián is the third largest silver mine in Mexico, having produced 13.3 Moz of silver and 44.5 koz of gold in 2023. Fresnillo reported 2P underground mineable Reserves at San Julián of:

| Ore Type |

Mt |

Au (g/t) |

Ag (g/t) |

Zn (%) |

Pb (%) |

AuEq* |

|---|---|---|---|---|---|---|

|

Epithermal Veins |

4.3 |

1.52 |

327 |

|

|

6.06 |

|

Disseminated Ore Body |

2.2 |

0.11 |

157 |

1.09 |

0.5 |

3.06 |

|

Total |

6.5 |

1.04 |

269 |

|

|

5.05 |

*Fresnillo plc Annual Report and Accounts 2023, pg. 339 (www.fresnilloplc.com/media/mumbsyvj/44314-fres-annual-report-2023-web.pdf) Gold equivalent formula: AuEq = Au + 0.014*Ag + 0.532*Zn + 0.379*Pb + 1.525*Cu (recoveries were assumed to be 100%). Metal Prices used: $1700/oz Au, $23.61/oz Ag, $1.32/lb Zn, $0.94/lb Pb and $3.78/lb Cu.

Drill results will continue to be received over the next few months as the program takes a short break during the peak of the rainy season in Mexico. Drilling will resume in September and continue through the winter months.

Figure 1- Known vein systems and existing drill holes at the Cristina Project. Resource pit in Figures 1 through 7 is based on the National Instrument 43-101 compliant report titled “Technical Report on the Mineral Resource for the Cristina Project” prepared for TCP1 and Atacama Copper by Independent Mining Consultants Inc., with an effective date of January 1, 2023, and issue date of December 1, 2023.

Figure 2 – Location of drill holes from the current release, Guadalupe vein system

Figure 3 – Long section through the Guadalupe vein system with drill holes from the current release

Figure 4 – Cross-section through the Guadalupe vein system with holes ACD24-231, showing grades increasing at depth below this hole.

Figure 5 – Cross-section through the Guadalupe vein system with hole ACD24-232 showing excellent continuity of the high-grade zone over several hundred vertical metres.

Figure 6 – Cross-section through the Guadalupe vein system with hole ACD24-233 and -234.

Figure 7 – Cross-section through the Guadalupe vein system with hole ACD24-235.

Table 1: Detailed Drill Results

| Drill Hole |

From |

To |

Drill length |

Est. True width |

Au |

Ag |

Zn |

Pb |

Cu |

AuEq |

Vein System |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

ACD24-231 |

220.0 |

224.9 |

4.9 |

4.3 |

0.33 |

14.8 |

0.21 |

0.07 |

0.05 |

0.75 |

Guadalupe |

|

and |

228.9 |

235.4 |

6.5 |

5.8 |

0.43 |

11.9 |

0.26 |

0.08 |

0.03 |

0.81 |

Guadalupe |

|

ACD24-232 |

343.5 |

354.7 |

11.2 |

9.0 |

0.70 |

33.1 |

2.12 |

0.71 |

0.15 |

2.79 |

Guadalupe |

|

incl. |

349.5 |

352.3 |

2.8 |

2.2 |

0.84 |

69.4 |

6.20 |

2.10 |

0.26 |

6.30 |

Guadalupe |

|

and |

370.8 |

372.1 |

1.3 |

1.0 |

0.44 |

78.1 |

1.63 |

0.07 |

1.52 |

4.73 |

Guadalupe |

|

ACD24-233 |

278.8 |

301.25 |

22.5 |

20.0 |

0.43 |

19.6 |

0.60 |

0.24 |

0.06 |

1.21 |

Guadalupe |

|

incl. |

282.8 |

283.55 |

0.8 |

0.7 |

0.65 |

65.1 |

7.22 |

2.41 |

0.14 |

6.52 |

Guadalupe |

|

ACD24-234 |

218.3 |

234.3 |

16 |

14.0 |

0.96 |

39.2 |

0.71 |

0.41 |

0.13 |

2.24 |

Guadalupe |

|

incl. |

231 |

234.3 |

3.3 |

2.9 |

2.78 |

75.0 |

0.33 |

0.66 |

0.98 |

5.10 |

Guadalupe |

|

ACD24-235 |

38.7 |

61.6 |

22.9 |

20.5 |

1.56 |

24.5 |

0.31 |

0.27 |

0.17 |

2.43 |

Guadalupe |

|

incl. |

49.3 |

50.6 |

1.3 |

1.2 |

22.30 |

184.0 |

0.87 |

0.82 |

1.42 |

27.80 |

Guadalupe |

Gold equivalent formula: AuEq = Au + 0.014*Ag + 0.532*Zn + 0.379*Pb + 1.525*Cu (recoveries were assumed to be 100%). Metal Prices used: $1700/oz Au, $23.61/oz Ag, $1.32/lb Zn, $0.94/lb Pb and $3.78/lb Cu.

The goal of targeting the higher-grade zones within the main Guadalupe Vein, as well as other high-grade veins in the area, is to both increase the size and the grade of the resource and demonstrate the underground resource potential at Cristina. The current, primarily open-pit mineral resource estimate comprises:

- Indicated resources of 17.5 Mt at 0.51 g/t gold, 33.8 g/t silver, 0.47% zinc, 0.19% lead and 0.04% copper (1.33 g/t AuEq grade), for a contained 752,000 gold-equivalent ounces.

- Inferred resources of 19.0 Mt at 0.51 g/t gold, 27.5 g/t silver, 0.50% zinc, 0.19% lead and 0.05% copper (1.27 g/t AuEq grade), for a contained 777,000 gold-equivalent ounces.

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Quality Assurance and Quality Control Procedures

Drill core at the Cristina project is predominately HQ size with a diameter of 63.5 mm. Drill core samples are generally 1.50 m long along the core axis with allowance for shorter or longer intervals if required to suit geological constraints. After logging intervals are identified to be sampled, the core is cut and one half is submitted for assay. Sample QA/QC measures include unmarked certified reference materials, blanks, and field duplicates are inserted into the sample sequence and make up approximately 5% of the samples submitted to the laboratory for each drill hole. Samples are transported to lab facilities in Durango or Hermosillo Mexico, for sample preparation. Sample analysis is carried out by ALS Labs, with fire assay, including over limits fire assay re-analysis, and multi-element analysis completed in North Vancouver, Canada. Drill core sample preparation includes fine crushing of the sample to at least 70% passing less than 2 mm, sample splitting using a riffle splitter, and pulverizing a 250-gram split to at least 85% passing 75 microns. Gold in diamond drill core is analyzed by fire assay and atomic absorption spectroscopy of a 30 g sample (Au-AA25). Multi-element chemistry is analyzed by 4-Acid digestion of a 0.25-gram sample split (ME-ICP61) with detection by inductively coupled plasma emission spectrometer for a full suite of elements. Gold assay technique Au-AA25 has an upper detection limit of 100 ppm. Any sample that produces an over-limit gold value via the initial assay technique is sent for gravimetric finish via method Au-GRA21. Silver analyses by ME-ICP61 have an upper limit of 100 ppm. Samples with over-limit silver values are first re-analyzed by ICP with a larger 0.4 g sample split, which has an upper limit of 1,500 ppm. Silver assays above 1,500 ppm are re-analyzed by fire assay with gravimetric finish Ag-GRA21. ALS Labs is an ISO/IEC accredited assay laboratory.

Qualified Person

Mr. Charlie Ronkos, MMSA is Atacama’s EVP Exploration and the Qualified Person who has approved the technical information disclosed in this release.

Mr. Jacob W. Richey, P.E. of IMC is the Qualified Person responsible for the MRE. Details of the Cristina MRE can be found in the Company’s press release of October 30, 2023, and in the National Instrument 43-101 compliant report titled “Technical Report on the Mineral Resource for the Cristina Project” prepared for TCP1 and Atacama Copper by Independent Mining Consultants Inc., with an effective date of January 1, 2023, and issue date of December 1, 2023. This report is available under the Company’s SEDAR profile at www.sedarplus.ca and on the Company’s website.

About Atacama Copper Corporation

Atacama Copper is a well-funded resource company adding value through the acquisition, exploration, and development of copper and precious metals projects in the Americas. The company is carrying out a drilling campaign at its Cristina precious metals project in Chihuahua Mexico, with the goal of significantly expanding the existing mineral resource estimate. Drilling is also planned for the Yecora copper project in Sonora Mexico. In Chile, the Placeton/Caballo Muerto project hosts several untested porphyry copper targets situated between the large-scale Relincho and El Morro/La Fortuna copper-gold deposits of the Nueva Union joint venture between Teck and Newmont Mining.

Atacama’s corporate presentation can be found at: https://atacamacopper.ca/investors/presentations/

Additional Information – Please Contact

Tim Warman

Chief Executive Officer and Director

Atacama Copper Corp.

Email: info@atacamacopper.ca

Cautionary Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to: the maiden resource estimate at the Company’s Cristina project; the drilling program at Cristina and the potential for MRE growth; future development plans; and the business and operations of the Company. Forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to business integration risks; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; fluctuations in currency markets; results of exploration; the economics of processing methods; change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties.

There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Atacama disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.